For most traders, an initial public offering (IPO) is the first opportunity to gain exposure to a company’s shares. Learn more about the IPO process and how to trade and invest in an upcoming IPO.

An investment in an IPO has the potential to deliver attractive returns, but sometimes investors lose a lot of money. Prior to investing, it is important to understand how the process of trading these securities differs from ordinary stock trading, along with the additional risks and rules associated with IPO investments.

How to Trade and Invest in IPO Stocks – Quick Guide

- Check the upcoming IPOs. Our guide includes key facts about upcoming debuts on Nasdaq’s IPO calendar and other major stock exchanges.

- Decide how to take a position on an IPO: With us, you can trade or invest in the shares once the company has completed the IPO.

- Build your IPO trading plan and strategy. Make sure you know about trade planning and risk management, including when you plan to take profits and cut losses.

What is an IPO?

There are thousands of companies that trade on the New York Stock Exchange (NYSE), Nasdaq, or Tadawul. These companies range from the leviathan Apple or Saudi Aramco to the smaller, more inconsequential companies, with market capitalizations of less than the price of a car.

Every one of those companies had to start somewhere. They each sprang to trading life with initial public offerings (IPOs), turning from private companies to public ones, attracting investors, and raising capital.

An initial public offering (IPO) is when a private company becomes public by selling its shares on a stock exchange.

Private companies work with investment banks to bring their shares to the public, which requires tremendous amounts of due diligence, marketing, and regulatory requirements.

Purchasing shares in an IPO is difficult as the first offering is usually reserved for large investors, such as hedge funds and banks.

Common investors can purchase shares of a newly IPO-ed company quickly after the IPO.

When an IPO has happened, you can go long or short on share prices through CFD trading or buy shares with ownership Remember, if you’re trading, you can profit from upward or downward share price movements.

How Does an IPO Work?

Going public is a challenging, time-consuming process that’s difficult for most companies to navigate alone. A private company planning an IPO needs not only to prepare itself for an exponential increase in public scrutiny but also so must file a ton of paperwork and financial disclosures to meet the requirements of the Securities and Exchange Commission (SEC), which oversees public companies.

That’s why a private company that plans to go public hires an underwriter, usually an investment bank, to consult on the IPO and help it set an initial price for the offering. Underwriters help management prepare for an IPO, creating key documents for investors and scheduling meetings with potential investors, called roadshows.

The underwriter puts together a syndicate of investment banking firms to ensure widespread distribution of the new IPO shares. Each investment banking firm in the syndicate will be responsible for distributing a portion of the shares.

Once the company and its advisors have set an initial price for the IPO, the underwriter issues shares to investors, and the company’s stock begins trading on a public stock exchange, like the New York Stock Exchange (NYSE) or the Nasdaq.

Why Do an IPO?

An IPO may be the first time the public can buy shares in a company, but it’s important to understand that one of the purposes of an initial public offering is to let early investors in the company cash out their investments.

Think of an IPO as the end of one stage in a company’s life cycle and the beginning of another—many of the original investors want to sell their stakes in a new venture or a start-up. Alternatively, investors in more established private companies that are going public also may want the opportunity to sell some or all their shares.

There are other reasons for a company to pursue an IPO, such as raising capital or boosting a company’s public profile:

- Companies can raise additional capital by selling shares to the public. The proceeds may be used to expand the business, fund research and development, or pay off debt.

- Other avenues for raising capital, via venture capitalists, private investors, or bank loans, may be too expensive.

- Going public in an IPO can provide companies with a huge amount of publicity.

- Companies may want the standing and gravitas that often come with being a public company, which may also help them secure better terms from lenders.

While going public might make it easier or cheaper for a company to raise capital, it complicates plenty of other matters. There are disclosure requirements, such as filing quarterly and annual financial reports. They must answer to shareholders, and there are reporting requirements for things like stock trading by senior executives or other moves, like selling assets or considering acquisitions.

Pros of IPOs

A successful IPO can raise massive amounts of capital, as becoming listed on a stock exchange can help to increase the exposure and public image of a company. In turn, the firm’s sales and profit can increase. IPOs are also beneficial to traders because it’s easier to buy publicly traded shares than those that only trade privately.

Cons of IPOs

Public companies are subjected to the rules and regulations of a governing body. One of the rules is that it is required to publicly disclose financials, such as accounting information, tax, and profits. IPOs also carry significant costs and could require the company to raise additional funding if its shares perform poorly.

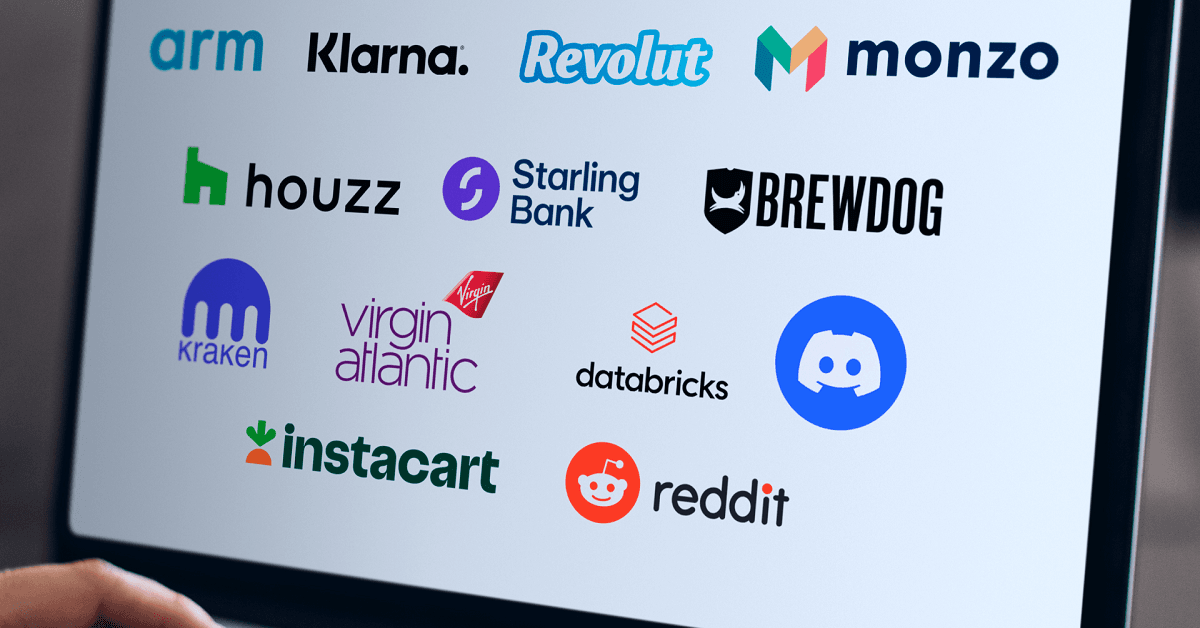

Upcoming IPOs 2024

It’s been a lackluster year for IPOs, as economic uncertainty has led many companies to take a ‘wait and see’ approach. However, more activity could be on the cards as 2023 progresses. Discover the US, Europe, UK, and Asia IPO contenders to watch.

1. Stripe IPO (estimated market cap: $74 billion)

2. Reddit IPO (estimated market cap: $15 billion)

3. Chime (estimated market cap: $40 billion)

4. Databricks IPO (estimated market cap: $31 billion)

5. TikTok Global (estimated market cap: $50 billion)

6. Discord (estimated market cap: $15 billion)

7. Blockchain.com (estimated market value: $14 billion)

8. Klarna (estimated market cap: $7 billion)

9. Revolut (estimated market cap: $33 billion)

10. Arm Holdings (estimated market cap: $23.95 billion)

11. EG Group (estimated market cap: $15 billion)

12. ByteDance (estimated market cap: $300 billion)

13. Ant Group (estimated market cap: $200 billion)

14. aCommerce (estimated market cap: $200 million)

Upcoming US IPOs

The American IPO space, particularly its tech stocks, shows no sign of slowing down in 2023. Are these the best upcoming US IPOs?

Stripe IPO (estimated market cap: $74 billion)

For Stripe, a major payment processing company based in San Francisco, life has gotten better. In March 2023, the firm announced that it had raised $6.5 billion from both current and new investors. Stripe was valued at $50 billion now, less than half as much as its peak value of $95 billion in March 2021.

Operational funding is not required by the cash haul. Instead, according to Stripe, it will be utilized to pay for stock award-related tax obligations as well as stock buybacks.

Due in large part to the surge in e-commerce during the epidemic, many investors thought that Stripe would be one of the most successful IPOs ever. Despite the decline in price, some investors are still very optimistic about an upcoming Stripe IPO.

Reddit IPO (estimated market cap: $15 billion)

Reddit's IPO has been dragging on despite a slaughter in the IT IPO market. It'll probably hold out until a better situation arises before firing.

After receiving more than $400 million in capital from Fidelity and other sources, the company received a valuation of $10 billion in August of last year. However, Fidelity Blue Chip Growth Fund (FBGRX) recently reduced the value of its Reddit stake from an earlier disclosure, down 7.36 percent. According to the update, Reddit is worth $5.5 billion in total.

On June 12, non-staff moderators of various well-known Reddit communities, such as those for gaming and music, started demonstrating against the social network's intention to start charging some developers for access to its data. Users are effectively locked out by the moderators. Reddit claims it is unable to continue supporting companies that make extensive use of its data.

Nevertheless, Reuters reported in February that Reddit is planning to go public later this year. The business hopes to profit from the enormous online community of people who share a wide range of interests. That group is the reason for early enthusiasm for an upcoming IPO by companies like Reddit.

Chime (estimated market cap: $40 billion)

Chime is a no-fee mobile banking platform. Chime, a fintech business that employs technology to automate and enhance the delivery of financial services, is technically not a bank. Chime connects with actual banks to provide debit and credit cards.

The 2019 valuation for Chime was $1.5 billion. In the summer of 2021, during the height of investor interest in fintech firms, its valuation surpassed $25 billion. When investors first saw Chime, it was expected to be valued between $35 billion and $45 billion. Chime made its debut in early 2022. but declared that it was postponing an IPO.

Databricks IPO (estimated market cap: $31 billion)

Companies in every business are now completely obsessed with big data. Databricks has established itself as a top supplier of solutions for implementing AI, streamlining database management, and even just producing excellent data visualization. In a nutshell, the business offers cloud-based data analytics driven by Artificial Intelligence.

In October 2022, when Databricks received its most recent capital, it was valued at about $33 billion. From $38 billion in August 2021, that amount decreased. The decline was consistent with the norm in the technology sector of reducing valuation during recessions.

The company is positioning itself to be a key player in the AI data/cloud computing area even as it delays going public. To compete with ChatGPT, it is creating its own AI. It has agreed to acquire Okera, a platform for AI-driven data governance. By investing in the data security platform and software business Immuta, Databricks is also bolstering its venture arm.

TikTok Global (estimated market cap: $50 billion)

Many people find the idea of a TikTok IPO to be fascinating, and it has been for some time. The worldwide division of the social media craze is said to be pursuing an IPO for the new business TikTok Global as early as mid-2020.

ByteDance, a Chinese business that owns TikTok, delayed preparations for its own July 2021 offshore listing after Chinese officials voiced worries about data security. According to sources from August 2021, the parent firm was addressing regulatory difficulties in order to prepare for its IPO, which would involve a Hong Kong listing and be scheduled to take place in 2022.

In 2020, TikTok Global appeared to need American buyers due to the Trump administration. Blue-chip giants Oracle and Walmart exhibited an interest in the wildly popular program which was valued between $50 billion and $60 billion. However, when US President Biden overturned the data privacy laws Trump had put in place, the sale of TikTok Global was abandoned.

There are currently no set dates for an upcoming TikTok Global's initial public offering (IPO), but it is anticipated that the company would list in the US and close out a new round of fundraising prior to doing so, still giving ByteDance a majority ownership in the business.

Discord (estimated market cap: $15 billion)

Discord, based in San Francisco, calls itself a "voice-over internet protocol company." To put it more simply, it is an online community-building tool that aims to join individuals with like-minded hobbies as well as friends and family members.

After raising $500 million in investment in September 2021, it was valued at $15 billion. This is an increase of more than twice the company's prior value, which was $7.3 billion following its previous funding round.

The company's valuation is anticipated to surpass $15 billion if it goes public, though. Discord is still aiming for some point in 2022, but there isn't a definite date for its IPO offering yet.

Blockchain.com (estimated market value: $14 billion)

Blockchain.com, a cryptocurrency trading platform with headquarters in London, is rumoured to be preparing for a US IPO sometime in 2023. According to a story from April 2022, Blockchain.com has started speaking with banks in preparation for an upcoming US IPO and might close the deal by the end of the year.

A private fundraising round valued Blockchain.com at $14 billion in March 2022. The company's valuation was reportedly reduced to just $3 billion in another investment round just six months later, amid rising regulation and economic unpredictability. How this decreased valuation will affect the company's IPO plans is not yet clear.

Upcoming EU&UK IPOs

Which of these could be the best European IPOs to follow?

Klarna (estimated market cap: $7 billion)

Global leader in "buy now, pay later" financing, Swedish financial company Klarna processes millions of transactions daily. The organisation, which was established in Stockholm in 2005, is a well-known name in online lending across the globe.

After completing a round of investment in the second half of 2021, Klarna was valued at $45.6 billion, potentially making it one of the largest fintech companies in the world.

However, in 2022, Klarna's worth fell due to the prospect of regulation and a crisis in consumer lending. In a funding round in July 2022, its worth was reduced by 85%, to just $7 billion. Despite this, the company continues to have strong fundamentals, with more than 150 million users and a 200% increase in its revenue from marketing services year over year.

Revolut (estimated market cap: $33 billion)

Revolut, a UK-based app-based bank with more than 15 million registered members, was established in 2015 and has been an electronic money institution subject to UK regulation since 2016.

Its core market is the UK, and a public listing is most likely to be on the LSE. However, the financial company is continuing to grow its US operations after adding to the leadership team in March 2022, so there's a chance it might go public in the US as well.

Nikolay Storonsky, the company's CEO and co-founder, stated in late 2021 that the company would require several billion dollars in yearly income before going public. But in July 2021, fundraising efforts brought in $800 million, lifting the market worth estimate to almost $33 billion (£25.3 billion).

Arm Holdings (estimated market cap: $23.95 billion)

Around 95% of smartphones use technology and software created by Arm Holdings, a microprocessor manufacturer. It employs about 6000 people worldwide, including 2800 in the UK.

Nvidia will purchase Arm from SoftBank, the holding company for Arm, in 2020, for an estimated $40 billion. However, the agreement collapsed in early 2022, with regulatory issues being cited as the main cause by Nvidia and Arm. Arm's estimated market valuation has since decreased to about $23.95 billion because of market volatility.

Although Arm is frequently referred to as "the crown jewel" of British technology, it is not yet known where Arm will go public. The US is the market that we're looking at for the listing of ARM,' Masayoshi Son, CEO of SoftBank, stated in early 2022, implying that Nasdaq - not the LSE - will be the company's market of choice.

The IPO, according to Son, will be one of the biggest in the history of technology. But the IPO is still on hold more than six months later. A dual listing may be in the works and has been circulating in rumors as well.

EG Group (estimated market cap: $15 billion)

With ac The British retailer EG Group is planning a massive IPO. The corporation operates more than 6300 gas stations and convenience stores throughout the US, Australia, continental Europe, the UK, and the UK.

By the midway point of 2022, EG Group had reported an EBITDA of $381 million and a turnover of $8.9 billion for the same period. In 2021, the company's revenue hit $26.5 billion.

Considering recent acquisitions like the 52 KFC locations in the UK, the Asda supermarket, and the Leon restaurant chain, many investors are closely monitoring the potential listing of EG Group. Mohsin and Zuber Issa, the company's wealthy owners, have been frustratingly evasive about their intentions to list the company publicly, most recently declaring that "an IPO for EG Group is one of a number of strategic options for the business being considered."

Upcoming Asia IPOs

Which pre-IPO Asia companies should you follow?

ByteDance (estimated market cap: $300 billion)

Asian startup After introducing its well-known TikTok app in 2017, ByteDance soon became well-known, especially among Gen Z, the post-"Facebook generation," and other social media users.

Reports from August 2021 state that the business is addressing regulatory issues to prepare for its Hong Kong IPO, which was initially projected to take place in the first quarter of 2022. However, ByteDance decided to put an end to its intentions to list abroad in July 2021 after local regulators voiced their concerns over data protection.

According to internal ByteDance documents, the company underwent a big restructure in November 2021. One of the changes was the creation of a new TikTok business unit, which may pave the way for an e-commerce TikTok platform.

At its height, ByteDance was valued at over $425 billion. However, the business decided to postpone its IPO plans indefinitely in September 2022 due to worries over a dramatic decline in its valuation. ByteDance chose to engage in a $3 billion share buy-back scheme, which gave the business a $300 billion valuation. If the business goes public, it will still be the largest IPO in history, even at this lower valuation.

Ant Group (estimated market cap: $200 billion)

Chinese online payment provider Ant Group was established by Jack Ma, who also founded Alibaba. Originally known as Alipay and created to support Alibaba, it underwent a rebranding in 2014 to become a distinct company known as Ant Group.

The first target date for Ant Group's initial public offering (IPO) was November 5, 2020. However, the Shanghai Stock Exchange said two days prior to the listing that the IPO will be postponed owing to regulatory concerns. Following this declaration, Ant Group itself suspended the Hong Kong listing. Its Shanghai-listed stock was scheduled to begin trading at 68.8 yuan, while the share price for its Hong Kong listing had been fixed at HK$80.

The Ant Group was estimated to be worth $191 billion in November 2021. With a market cap of $315 billion, the 2020 valuation in advance of its IPO-that-was would have made it the biggest IPO debut in history. This amount is far lower. However, some investors now estimate it to be worth somewhat more than $200 billion.

One year later, reports of Ant Group's considerable restructuring to bring it into compliance with Chinese regulations started to surface. Although an IPO date has not yet been set, this development has raised hopes that the business may IPO shortly, perhaps later in 2022.

aCommerce (estimated market cap: $200 million)

Southeast Asia's aCommerce, based in Thailand, offers end-to-end e-commerce management services. This comprises services for customer service, fulfillment, and delivery as well as data and analytics, online shop creation, and digital marketing solutions.

It was established in 2013 and has since developed into one of the biggest e-commerce companies in Asia, with support from companies like the American investment firm KKR

Due to "volatile market conditions driven by macroeconomic uncertainties," aCommerce decided to postpone its first public offering (IPO), which it had initially planned to make in 2022 on the Stock Exchange of Thailand. Pre-IPO fundraising is thought to have totaled approximately $118 million, coming from both new and current investors.

CEO Paul Srivorakul stated that the company might raise $200 million through its IPO in a 2020 interview. By the end of the first quarter of 2023, this exciting upcoming IPO is anticipated to become active on the Thai stock exchange.

Key IPO Terms

Like everything in the world of investing and financial markets, initial public offerings have their own special jargon. You’ll want to understand these key IPO terms:

- Common stock. Units of ownership in a public company typically entitle holders to vote on company matters and receive company dividends. When going public, a company offers shares of common stock for sale.

- Issue price. The price at which shares of common stock will be sold to investors before an IPO company begins trading on public exchanges. Commonly referred to as the offering price.

- Lot size. The smallest number of shares you can bid for in an IPO. If you want to bid for more shares, you must bid in multiples of the lot size.

- Preliminary prospectus. A document created by the IPO company that discloses information about its business, strategy, historical financial statements, recent financial results, and management. It has red lettering down the left side of the front cover and is sometimes called the “red herring.”

- Price band. The price range in which investors can bid for IPO shares, set by the company and the underwriter. It’s different for each category of investor. For example, qualified institutional buyers might have a different price band than retail investors like you.

- Underwriter. The investment bank manages the offering for the issuing company. The underwriter determines the issue price, publicizes the IPO, and assigns shares to investors.

How to Evaluate Buying an IPO Stock

If you've decided on buying IPO stock, be sure to consider the strengths of the business itself. Ask yourself a few key questions:

- If this business does not grow at a high enough rate to justify its price, what is the reason? What are the probabilities of those failures occurring?

- What are the competitive moats that protect the business? Are there patents, trademarks, key executives, or some other unique factor protecting it?

- What is stopping some other firm from coming in and destroying the attractive economics?

Also, consider your personal level of comfort with the business and how it is run:

- Would you be comfortable owning this business if the stock market were to close for the next five, 10, or 25 years? In other words, is this business model and the company's financial foundation sustainable? Or is obsolescence because of technological advancement or lack of sufficient capital a possibility?

- If the stock falls by 50% due to short-term problems in the business, will you be able to continue holding your shares without any emotional response?

Do your due diligence on the company and its prospects before plunking capital down. It may be difficult to do, as the company hasn't made a good deal of financial information public to that point, but it's crucial to your success.

Metrics for judging a successful IPO process

The following metrics are used for judging the performance of an IPO:

- Market Capitalization: The IPO is successful if the company’s market capitalization is equal to or greater than the market capitalization of industry competitors within 30 days of the initial public offering. Otherwise, the performance of the IPO is in question.

Market Capitalization = Stock Price x Total Number of Company’s Outstanding Shares

- Market Pricing: The IPO is successful if the difference between the offering price and the market capitalization of the issuing company 30 days after the IPO is less than 20%. Otherwise, the performance of the IPO is in question.

How to buy or trade IPO stock

- Research the market. Some currently private businesses have potential to become rivals within the technology, energy, finance, e-commerce, and healthcare industries.

- Buy pre-IPO stock through a participating broker. Several trading platforms allow you to invest in the company before its future IPO is carried out.

- If this is not an option, you can trade on the company once it is public. This is often through financial derivatives, such as CFDs with the option to trade with leverage.

- Pick a strategy. Choose whether you want to go long (buy) or go short (sell). Please note that some trading restrictions may apply on initial trading.

- Keep up to date with news and analysis. This can include daily reports and predictions from professional market analysts and external news providers.

To trade CFDs on the price movements of an upcoming IPO after it has passed the process, it's a simple process to register for a live account with us and get started now.

Investing in the primary market lets you take a position on the company’s stock pre-IPO; investing in the secondary market will give you ownership of the shares once the company has completed its IPO.

With us, you can invest in the company’s shares with an Invest account on the secondary market. You can also trade on the company’s share price on the secondary market with derivatives like CFDs.

Buying shares

You can create an Invest account to invest in shares once they’re listed on the stock exchange.

When you’re investing, you’ll pay the full value of the position up front which will give you direct ownership of the company’s stock. This’ll make you a shareholder, and you’ll be eligible to receive any dividends that the company pays and get shareholder voting rights if the company grants them.

Trading derivatives

You can create a Trading account to speculate on a share’s price movements with derivatives like contracts for difference. Before the IPO, you can use these derivatives to trade our grey market, and after the IPO you can use them to speculate on a stock’s price rising (by going long) and falling (by going short.

You might choose derivatives because they enable you to open a position with leverage, which requires a small deposit (margin) rather than committing the full value of the shares upfront. This can magnify profits and losses, as both will be calculated from the full exposure of the trade, not just the margin you put up a deposit.

Should You Trade or Invest in the Upcoming IPOs?

As with any type of investing, putting your money into an IPO carries risks—and there are more risks with IPOs than buying shares of established public companies. That’s because there are less data available for private companies, so investors are making decisions with more unknown variables.

Despite all the stories you’ve read about people making bundles of money on IPOs, there are many more that go the other way. In fact, more than 60% of IPOs between 1975 and 2011 saw negative absolute returns after five years.

Just because a company goes public, doesn’t necessarily mean it’s a good long-term investment.

Conversely, a company might be a worthwhile investment but not at an inflated IPO price. You could buy the best business in the world, but if you overpay for it by 10 times, it’s going to be hard to get your capital back out of it.

Buying IPOs, for most buyers, isn’t investing—it’s pure stock speculation, as many of the shares allocated in the IPO are flipped on the first day. If you really like the stock and plan to hold it as a long-term investment, it is recommended to wait a few weeks or months until the frenzy has disappeared, and the price has come down.

The Benefits of Buying IPO Stock

The Downsides of IPO Investing

Buying IPO stock can be appealing. A block of common stock bought during an initial public offering has the potential to deliver huge capital gains decades down the line. Even just the annual dividend income of an extraordinarily successful company can exceed the original investment amount, given a few decades' time. Your investment provides capital to the economy, enabling companies that provide real goods and services to grow and expand. Learning how to buy IPO stock can lead to extremely attractive results when conditions are right. The biggest downside for IPO investors is dealing with volatile price fluctuations. It can be hard to stay invested when the value of your shares plummets. Many stockholders don't stay calm when prices tumble. Rather than valuing the business and buying accordingly, they look to the market to inform them. However, in doing so, they fail to understand the difference between intrinsic value and price. Instead, consider whether look-through earnings and dividend growth are growing and poised to stay that way.

The Bottom Line

The late and legendary Benjamin Graham, who was Warren Buffett's investing mentor, decried IPOs as being for neither the faint of heart nor the inexperienced. They're for seasoned investors; the kind who invest for the long haul, aren't swayed by fawning news stories and care more about a stock's fundamentals than its public image.

For the common stock investor, purchasing directly into an IPO is a complicated process, but soon after an IPO, a company's shares are released for the public to buy and sell. If you believe in a company after your research, it may be beneficial to get in on a growing company when the shares are new.

Free resources

Before you start trading and investing in the upcoming IPOs 2024, you should consider using the educational resources we offer like CAPEX Academy or a demo trading account. CAPEX Academy has lots of free trading and investing courses for you to choose from, and they all tackle a different financial concept or process – like the basics of analyses – to help you to become a better trader or make more-informed investment decisions.

Our demo account is a suitable place for you to learn more about leveraged trading, and you’ll be able to get an intimate understanding of how CFDs work – as well as what it’s like to trade with leverage – before risking real capital. For this reason, a demo account with us is a great tool for investors who are looking to make a transition to leveraged trading.