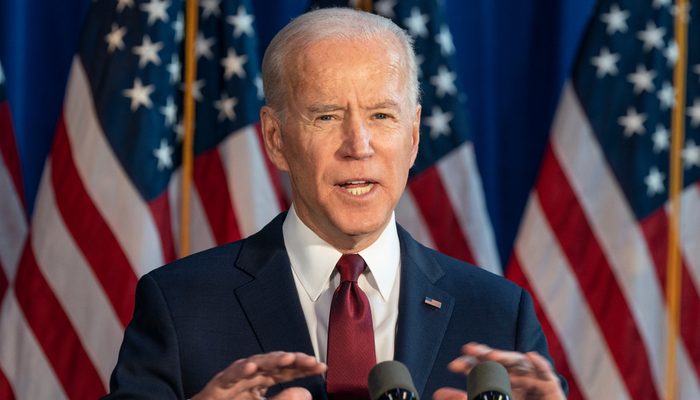

Investors begin to weigh in President Biden’s new stimulus package, and its possible inflationary effect is reflected in the fixed income market.

Significant advances are being reported in the bipartisan talks regarding the $1.9 trillion aid, an amount that is said to support companies affected by the pandemic crisis. Additionally, a large part of it would go directly to the population and is expected to have an immediate impact on spending capacity.

This boost to private spending together with the increase in the price of raw materials, (especially Oil, which is in an upward movement that has overcome levels not seen since January 2020), has caused market participants to fear an inflationary rebound.

Another factor to take into account in this regard is the abrupt increase in freight costs in China, motivated by the growth in exports from this country, accompanied by a similar rise in Europe, causing a shortage of available containers for shipping.

Faced with this scenario of generalized price rises and with an expected greater purchasing power of U.S consumers, inflation expectations increased, reaching a level of 1.20% not seen since the end of last February.

This has a direct effect on the price of the US Dollar, maintaining a positive correlation with interest rates, especially with the longer references of the curve. Such a movement reflects in the price of the USD/JPY, the pair most sensitive to this situation, which is also driven upwards by the improved market sentiment.

From a technical perspective, the pair is at an important resistance level at 105.60, where the 200-day SMA line passes, in addition to being the trigger point of a reversal pattern that if exceeded and confirmed with a daily close above this level, would point to a theoretical target around the levels of 108.50.

Sources: Bloomberg, Reuters.