Advanced Micro Devices Inc keeps on surprising the markets.

A couple of days ago, AMD posted a second-quarter net income of $157 million, or 13 cents per share, beating last year's $35 million, with an EPS of 3 cents. It also reported adjusted earnings of 18 cents/share, significantly more than last year’s 2 cents a share.

AMD's revenue increased to $1.93 billion from $1.53 billion reported last year in the same quarter. It exceeded both the forecasted adjusted earnings and the revenue: 16 cents EPS, and $1.85 billion, respectively.

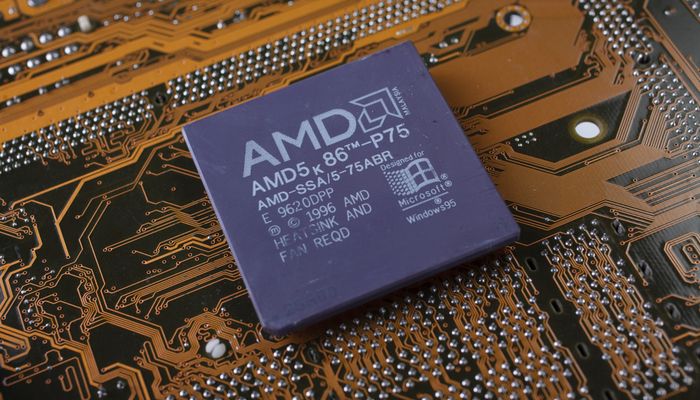

The company’s results came after Intel announced that it would postpone releasing its 7-nanometer chips until at least early 2023 due to manufacturing issues. AMD has already rolled out 7nm chips for servers and personal computers. For the past quarter, the sales from computing and graphic chips came in at $1.37 billion – a 45% increase from last year’s $940 million, exceeding analysts’ expectations.

For AMD, it seems that the good news brings other good news. The stock surged 13%, a new record for the company. The increase was pushed by both positive Q2 earnings and analysts' forecasts that can be met if Intel's chips will be available in two years, as forecasted. The price target was raised to $86 with a high of $90 from $63.

Analysts' outlook for AMD's third-quarter earnings is positive, as it is expected for the company to outperform Intel. The next revenue is likely to be at $2.49 billion. However, its revenue is said to be limited by the availability of its 7 nm chips.

After the estimates, AMD stock price gained roughly 13%. This year, shares went up 66%, while TECH100 added 18%, and USA500 rose 0.9%.

Visit CAPEX.com and see what other surprises the markets have had!

Sources: marketwatch.com, cnbc.com