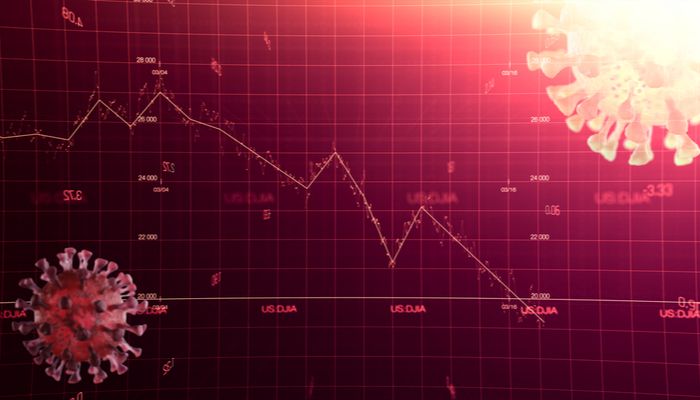

The market ended the week with a choppy trading session dominated by indecision as a result of the uncertainty caused by the pandemic situation.

With little significant variations concerning the previous day, especially if we compare the volatility with that of former days, the European stock markets ended with slight losses in contrast to the North American ones that have experienced weak gains.

The indecision of the EU on the stimulus packages and bad data of the German IFO 74.3 vs. 80 expected have weighed on the European indices.

Germany30 recovered part of what was lost in the session to finish practically unchanged.

US markets

USA500, the best performing American index in recent days, was up over 1.5%. This index has benefited from the increases experienced by technology companies such as Amazon and Microsoft, which the market expects to be less affected by the pandemic crisis. Thus, after a short drop at the start of the crisis, both stocks quickly recovered to levels close to their all-time highs.

The market, therefore, anticipates excellent results from these companies' earnings that will be published next week. The risk is that these results will disappoint, even partially, or even that being close to what is expected, investors could "buy the rumor and sell the news."

Taking into account the high weight of these stocks in the index, the evolution of these stocks and specifically their results will be crucial for the index.

From a technical analysis point of view, USA500 may be forming an unusual pattern known as a diamond pattern, as can be seen in the chart.

It is a bearish reversal pattern. But for this formation to be confirmed, the index must not exceed the area around 2840, very near to today´s close level, and close daily below 2,740-2,750.

On the other hand, the new package of support for small and medium-sized companies approved by President Trump, and the suggestion by Mnuchim that the Government could take stakes in energy companies that are being severely affected by the crisis is helping maintain the American stock markets afloat.

In the currency market, stable performance and low volatility. The Euro was losing territory in the first hours of the session due to the uncertainty about the decisions of the European Commission. The peripheral bonds have not yet suffered from selling pressure, possibly due to the purchases that the ECB is making daily. Still, the general sentiment of the market is that as time goes by, this effect will fade if robust measures are not taken to avoid the more than inevitable deterioration of the European economies, and therefore the Euro will lose momentum.

EUR/JPY was the weakest euro cross ending the day around the 116.00 zone.